Residential and Commercial Real Estate Services

Serving the Dallas-Fort Worth and Houston Area

Caprice Michelle LLC

Real Estate Brokerage

Rockwall, TX

Real Estate Brokerage

214-789-7364

With unparalleled industry knowledge, experience, and local expertise, we're the Rockwall, TX Real Estate experts you've been looking for. Whether you're buying

or selling, we can help you get the best deal. Just looking? That's OK. Use our website all you like, but you'll have to create a free account to unlock all the best search features. Once you sign up, you'll be able to save listings, save your search criteria, get automated email updates for new homes matching your saved search criteria, and more. Good luck on your house hunt! We hope to hear from you soon.

"I bought a home several years ago with Caprice and she was the consummate professional. Very well versed in the area and the market. I highly recommend her for your home purchase or sale."

- user009957

Button

"Caprice says help me buy two houses and sell one everything went perfectly as planned she got me the top dollar for selling and the best value for buying couldn't ask for a better realtor."

Write your caption hereButton

"Ms. Michelle was a great help in selling our property. She stayed on top on the sales in the area, how to try different methods to sell the property. I would recommend her to anyone and would use her services again. Thanks you"

- acaa67

Button

-

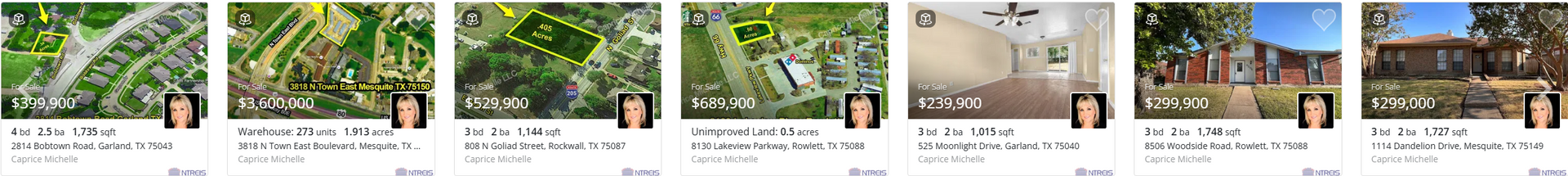

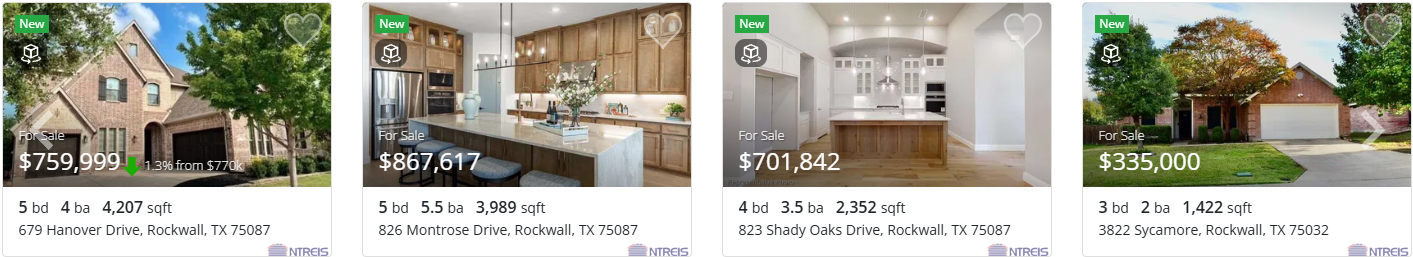

ROCKWALL

ButtonUnder $200,000

$200,000 to $300,000

$300,000 to $400,000

$400,000 to $500,000

$500,000 to $600,000

Luxury Homes

Commercial

Waterfront

Golf Course

Condos/Townhouse

New Construction

-

ROYSE CITY

ButtonUnder $200,000

$200,000 to $300,000

$300,000 to $400,000

$400,000 to $500,000

$500,000 to $600,000

Luxury Homes

Commercial

Waterfront

Golf Course

Condos/Townhouse

New Construction

-

DALLAS

ButtonUnder $200,000

$200,000 to $300,000

$300,000 to $400,000

$400,000 to $500,000

$500,000 to $600,000

Luxury Homes

Commercial

Waterfront

Golf Course

Condos/Townhouse

New Construction

-

ROWLETT

ButtonUnder $200,000

$200,000 to $300,000

$300,000 to $400,000

$400,000 to $500,000

$500,000 to $600,000

Luxury Homes

Commercial

Waterfront

Golf Course

Condos/Townhouse

New Construction

Buy A Home

Tell us your home search criteria, and we'll get to work immediately. Together, we'll find your next dream home.

Sell Your Home

If you're interested in selling your home, please provide us with some basic information so we can get the process started.

Market Analysis

Want to know what your home is worth? We can provide you with comparable sale information for your neighborhood.

Property Search

Just browsing? That's Okay! Jump right into home search results, narrow your search criteria, and see what's out there.

Sign Up

Sign up so you can save and edit your personal search criteria - you'll be the first to know when matching properties come to the market.

Contact Us

Have a question? Want more information? Let's get in touch. Contact us and we'll get back to you as soon as possible.

Unlock Your

Search

Unlock the search interface so you can browse homes without restrictions or interruptions.

Save Your

Favorites

Save your favorite searches and listings for later. They'll be waiting for you when you come back.

Get Email

Notifications

Get notified when new homes are listed that match your search criteria.

Free $1000 Buyer rebate when we represent you on new construction purchases or new builds.

Frequently Asked Questions

For additional information or support, feel free to contact us at 214-789-7364.

Why is Caprice Michelle LLC so popular?

Caprice Michelle LLC has gained immense popularity due to our exceptional real estate services in Rockwall. With over a decade of full-time experience in real estate sales, our founder brings unparalleled industry knowledge and local expertise to our clients. Our commitment to providing the best real estate services means that whether you're buying or selling, we help you achieve your property goals. Our comprehensive suite of real estate services includes commercial properties, rental properties, and affordable homes for sale, ensuring that every client's needs are met. We also offer $0 down deposit homes, new home buyer incentives, and closing cost assistance, making homeownership more accessible. Our dedication to delivering top-notch real estate services has established us as a trusted name in Rockwall. Experience the advantage of working with us by exploring our real estate services today. Contact us to begin your journey in the property market, and discover how our real estate services can make a difference for you.

What types of properties do you specialize in?

At Caprice Michelle LLC, we specialize in a diverse range of properties, from residential homes to commercial properties. We are experts in buying and selling commercial free-standing buildings, strip centers, and investment properties. Additionally, we are committed to helping new home buyers with incentives and closing cost assistance. Whether you’re looking for a rental property or affordable homes for sale, we have the expertise you need. Start your property search with us today and let us guide you to your next investment or dream home.

How can Caprice Michelle LLC assist new home buyers?

We offer a variety of incentives for new home buyers, such as $0 down deposit homes, free home buyer rebates, and closing cost assistance. Our team understands the challenges first-time buyers face and provides valuable guidance throughout the home buying process. With our real estate expertise, we make purchasing your first home a seamless experience. Ready to take the first step toward homeownership? Contact us for more information, and let's make your dream a reality.

Do you offer services in locations outside of Rockwall?

Absolutely! While Rockwall is our home base, we extend our services to numerous locations across North Texas, including Dallas, Frisco, Plano, and more. Our extensive network and market understanding allow us to cater to clients in various areas, ensuring that you find the perfect property that meets your needs. Explore our services in your area today or reach out to discover more about how we can help you find your next property.

What sets Caprice Michelle LLC apart from other real estate companies?

What truly sets us apart is our deep-rooted experience and commitment to client satisfaction. Having been in real estate sales full-time since 2010 and as an investor since 1990, our founder brings a wealth of knowledge and dedication to each transaction. We pride ourselves on personalized service, ensuring that every client receives the attention they deserve. Discover the difference with Caprice Michelle LLC and let us help you achieve your real estate goals. Contact us today to see how we can assist you.

Real Estate Services

Caprice Michelle LLC.

Real Estate Brokerage

Caprice Michelle, Broker

Rockwall, TX 75032

Phone: 214-789-7364

Email: Capricemichelle@gmail.com

www.capricemichelle.com

All Rights Reserved | Caprice Michelle LLC